Protect your investment and maximize value

Our institutional and private lenders participate in high-profile transactions by taking advantage of our diverse connections, deep industry knowledge and strategic due diligence practices.

Access to Alternative Asset Classes

Capital sources benefit from risk-adjusted returns and cash flow through our exceptional project line up. With a proven 15-year track record, we deliver success through solution-driven approaches while effectively mitigating risks.

Our private and institutional lenders can gain access to the Canadian real estate market through secure lending positions. Alternative assets can provide diversified exposure to a lender’s portfolio while achieving appropriate yields.

Diverse and High-Quality Real Estate Projects

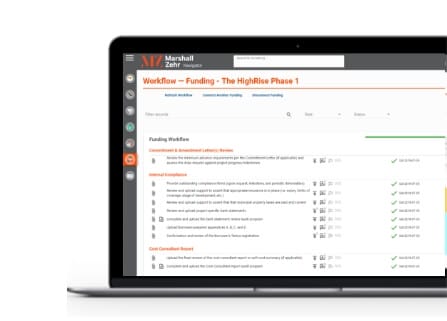

Our disciplined underwriting, origination and governance practices allow us to source and identify exceptional projects, giving lenders unique access to quality lending opportunities in the Canadian real estate sector. Lenders can participate in a diverse range of project types and geographic markets.

MarshallZehr sources real estate transactions through established developers in markets throughout Ontario and British Columbia.

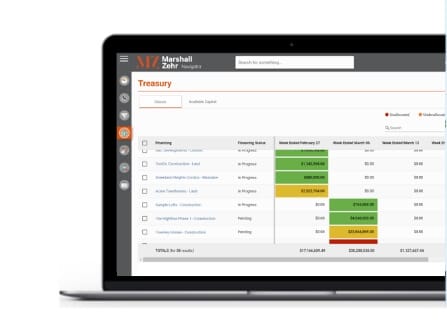

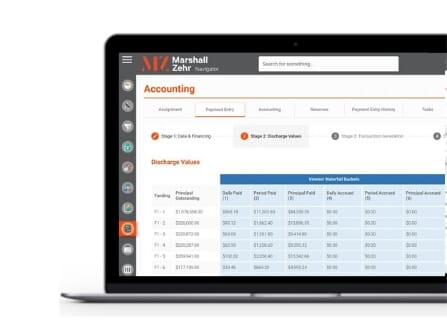

Mortgage Administration

We deliver the strategic insight necessary to craft tailored financial solutions, all backed by our industry recognized mortgage administration services.